Improve the earned revenue tax credit score; create a toddler tax credit score to help CT households, enhance financial system

Nearly four in ten families in Connecticut struggle to make ends meet each month – putting food on the table, keeping a car running, paying the rent, and looking after their young children while they are at work work available to them in our state. It is time for Connecticut to take action to help these families. The United Ways of Connecticut supports restoring state earned income tax credits and creating a state tax credit for children as doable and effective steps to help our families – while boosting our economies.

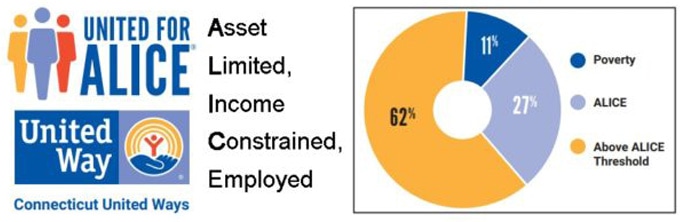

The United Ways of Connecticut has worked for six years to provide reliable, realistic data on what it costs to live in Connecticut. This project is called ALICE – a study of families that are Asset-L.imitated, Iincome-C.burdened and E.used. The Connecticut 2020 ALICE report reflects the following: 38% of households – approximately half a million families in our state – were struggling to make ends meet prior to the public health emergency of COVID. As of 2020, a family of four with one infant and one toddler was costing more than $ 90,000 a year just to meet their basic needs. 57% of black households in our state, 63% of Hispanic households and 73% of single households with females and children live at or below this ALICE threshold.

For these families, every hour of every day is filled with the stress and worry of how to keep food on the table, pay the rent, buy the new shoes a child needs, or afford the high cost of medicines needed. Persistent stress not only has a dramatic impact on health and health outcomes. Research shows that child poverty is also linked to dire health outcomes.

Americans take great pride in the fact that our national history has been marked by great strides and achievements in reducing poverty and increasing opportunities. But the developments of the last two generations in our country leave us with conditions that point in the opposite direction.

Manufacturing – once the engine of the US economy and the source of secure, well-paying jobs for so many Americans – has stalled. In 1960 about one in four American workers was employed in manufacturing; Today that number is less than 1 in 10. That trend has had a big impact on Connecticut: According to the Department of Labor, Connecticut had 152,200 people in manufacturing as of February 2021 – roughly half the 1990 figure (307,000).

The vast majority of people in our country now work – or have worked before COVID – in retail. Before COVID, around 350,000 Connecticut residents were working in retail business in 2020, according to the National Retail Federation. In the past two decades, many large retailers have gone from 70 percent to 80 percent full-time to at least 70 percent part-time. A single mom who works in a coffee shop may have to work four hours in the morning just to work when traffic is the heaviest, rather than a full eight-hour shift. This means savings in labor costs for their employer. But she cannot make ends meet with four hours of earnings a day.

At the same time, wages have not kept pace with the cost of living, even for those jobs that stay full-time or near it.

The Pew Research Center reports that the average hourly wage in America peaked more than 45 years ago. The average national wage rate of $ 4 an hour in January 1973 then bought what $ 23.68 would buy today, which is the equivalent of $ 49,250 a year. The median hourly wage for an American worker is now $ 19.33 an hour. This means that the average worker has lost nearly $ 10,000 in annual purchasing power compared to 1973. That’s $ 10,000 less a year to pay the rent, turn on the lights and burn the stove, put groceries on the table, or save up for a kids’ college. It’s no wonder, as the Federal Reserve has shown, 40% of Americans today don’t have $ 400 in savings to fall back on in the event of a crisis.

In Connecticut, the typical worker has not seen a real (adjusted for inflation) increase in the past two decades. This means that the typical worker in our state has seen an hourly wage decline over the past 20 years. Again, equity concerns are growing sharply: the Connecticut middle black worker is paid $ 14.85 hourly and the Hispanic middle worker is $ 15.67 hourly.

The United Ways of Connecticut believe that we can and must take concrete steps to address these inequalities and help families in our state meet their needs. First and foremost, we support restoring the state’s income tax credit to at least 30% of the federal EITC and introducing a state-level child tax credit.

Taking these two steps together would help meet the core need of 38% of Connecticut families: a lack of income to afford the basics. Putting money in the pockets of these families can help them escape the daily stress and trauma of simply not having enough income to support their families. And putting money in the wallets of these Connecticut residents will fuel the economy. Research from Moody’s shows that for every dollar of EITC a family earns, they return $ 1.24 to the economy. For every dollar of CTC they give back $ 1.38. These expenses would then provide income for other families in the state who in turn would increase their own expenses, creating a positive cycle throughout the state economy.

It is time to take these steps to help Connecticut families and make a solid investment that will pay off for years to come.

Lisa Tepper Bates is President and CEO of the United Way of Connecticut. Donna Osuch is chair of the United Ways of Connecticut Council of Chief Professional Officers.

CTViewpoints welcomes refuting or opposing views on this and all of its comments. Read our guidelines and leave your comment here.

Comments are closed.