Walz’s funds: extra help for these hit hardest by pandemic; extra taxes on the wealthiest Minnesotans

Given the timing of Governor Tim Walz’s budget launch this year, it’s probably best to think about concepts, not numbers.

As with all Minnesota governors, Walz had to set a budget before real spending and revenue projections were available, and base his proposal on a November forecast for the next two years – numbers that were almost instantly out of date.

Lawmakers, who actually have the budget to pass by June 30, have the pleasure of using the February forecast – numbers thanks to the impact of the $ 900 billion COVID relief package passed by Congress in December , very likely to look a lot better. There could be a larger surplus than the $ 641 million reported in November (based on the $ 217 million aid package passed by lawmakers last month). and there could be fewer projected deficits for the next fiscal cycle than November’s $ 1.27 billion forecast. In fact, the deficit could go away completely.

Happy timing for the legislature, less so for Walz and his management and budget department.

Article continues after advertisement

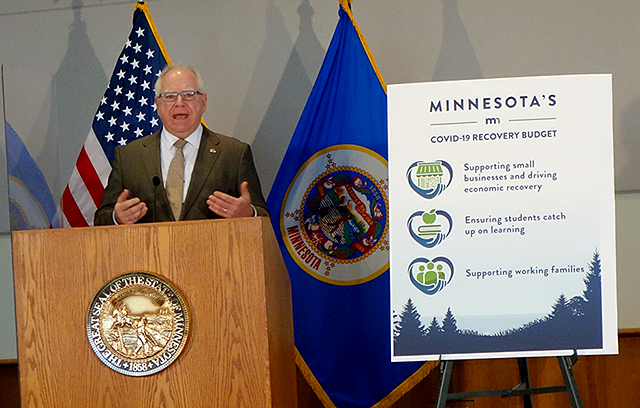

Although the proposed spending and expected income in his plan must be balanced, Walz stuck to larger subjects, not math, in introducing what he called “Minnesotas.” COVID-19 recovery budget” on Tuesday:

It costs $ 52.4 billion over two years.

It increases spending from the current budget by $ 1.3 billion.

It uses $ 1.04 billion from the state’s Rainy Days Fund, leaving behind $ 847 million.

$ 130 million will be withdrawn from the US Bank Stadium reserve, leaving $ 100 million.

It is raising government taxes – on corporate income, income of high earners, and on vaping and cigarettes – to increase them $ 1.66 billion in sales.

It increases the number of lower-income residents eligible to pay the lowest income tax rates and saves these Minnesotans $ 230 million.

It adds expenses in public education for general support and summer school, small business support, Childcare grants, tuition fee assistance for job changers and others social and economic support related to the pandemic.

New tax bracket for households earning at least $ 1 million

Walz said his plan, which also includes some budget cuts totaling $ 150 million, was due to three phenomena over the past year: the cost of the state’s response to COVID-19; the negative effects of the pandemic disproportionately affecting low-income Minnesotans; and the lack of impact of the recession on middle and high income tax brackets.

Article continues after advertisement

“This is a budget that reflects Minnesota’s feeling that those who have hit COVID hardest need to help us,” he said. “We help our own.”

But he said he also wanted to put more money into education and training for the workforce. “We have an ecosystem here that is trying. We have great talent here. We have a high quality of life. We cannot jeopardize this by cutting the very things on the bones that make a difference, “said Walz when he revealed his plan on Tuesday.

Minnesota Management and Budget

He again advocated paid family and sick leave insurance and suggested increasing support for working families with more spending on schools and childcare.

And he said hFor this he would pay a tax on those who did better during the pandemic. Since his proposed fifth income tax bracket – for couples earning $ 1 million or more – will hit about 0.7 percent of taxpayers, Walz called it “1 percent to 1 percent”.

“We will ask those who are most fortunate and those companies that have benefited from it during this time to do more,” said Walz.

The governor, who spent 12 years in Congress, said he understands how budgets created by senior executives are sustained by lawmakers. “Here’s how it will work: We’re going to get some tough numbers in February; We will adjust our budget slightly from these numbers and from now until this third week in the week of May the legislature will poke holes and try to say things and develop its own budget, ”said Walz. “That’s a good thing, Minnesota, a healthy thing.”

But just as GOP lawmakers were discussing their reactions to Walz’s budget ahead of Walz’s press conference on Tuesday, the governor gave his response to their reactions to their pre-press conference. “I could have written the press releases my Republican friends publish. That’s the thing we’re going through, ”said Walz. “When the economy is doing well, cut taxes. When the economy is bad, lower taxes.

Minnesota Management and Budget

“Yes, I am ready to compromise, yes, I am ready to listen to you,” Walz said of the Republican legislature. “But I’ll tell you what I won’t do. I will not compromise on the safety of Minnesotans, and I will not compromise on recovery – especially among students, small businesses, and working families. “

“A Line in the Sand” for Senate Republicans

Budget rollouts trigger a range of comments and reactions: DFL lawmakers and organizations that are their allies – SEIU, Education Minnesota, Isaiah, Alliance for a Better Minnesota – support the budget plan. The GOP lawmakers and their allies – the Minnesota Chamber of Commerce, Americans for Prosperity – weren’t that in love.

Supporters focused on spending, opponents on taxes.

Article continues after advertisement

“While some of the governor-recommended investments are justified, the tax increases required to support this level of ongoing spending will push Minnesota out of the competitive rankings and jeopardize our economic recovery,” said Doug Loon, president of the Minnesota Chamber of Commerce . “We will continue to advocate an economic recovery that does not penalize private sector employers, but benefits all Minnesotans.”

“Regardless of what the Minnesota Conservatives say, asking hugely profitable corporations and the richest Minnesotans to pay their fair share is right, and has helped Minnesota in the past,” said Joe Davis, executive director of Alliance for a Better Minnesota.

But the comments of one group of Minnesotans carry more weight than others. Because of their majority control over the Senate, Republican members of this chamber can block Walz’s initiatives – even if they have the support of the DFL majority in the house. However, they cannot adopt their own ideas without getting the approval of the house and von Walz.

MinnPost photo by Peter Callaghan

Senate Majority Leader Paul Gazelka

Senate Majority Leader Paul Gazelka said no tax hikes were “a line in the sand we drew” and said that the priorities of the DFL and GOP “are in some ways opposites”.

Gazelka said the budget can be offset by increasing the use of the Rainy Day Fund and budget cuts of 5 percent for each state agency. “We want Minnesota to be affordable. One of the things we’re going to say is that we’re not going to collect taxes on anyone,” said the East Gull Lake Republican. “If you look at the budget proposed by the governor, there are a lot of taxes for a lot of people.”

Gazelka also said the 2021 session would be difficult due to COVID-19 and the legislature’s largely distant work. “We have to focus on the basics, not some of these other things. In a session that is almost impossible to navigate, we are not going to do many new political things, ”said Gazelka. “Minnesotans need to get back to their lives: kids at school, running businesses, daily living that is not under the weight of this virus.”

Kurt Daudt, minority chairman of the House of Representatives, R-Crown, said the impact of tax hikes would not just fall on the rich and corporate. Vaping and cigarette taxes are lower for residents with lower incomes. And corporate tax hikes often hit residents with price increases and job losses. “There are a lot of taxes on people that we need to be successful now, and those are job creators, these are companies,” said Daudt. And the tax cut in the lowest tax bracket will be small – an average of $ 136 per year.

“This is a talking point, it’s not a tax cut,” he said of saving $ 3 a week. “I don’t think you can get a $ 3 cup of coffee at Caribou.”

Senate Finance Committee chairwoman Julie Rosen, R-Vernon Center, sponsor of the bill, which includes 5 percent reduction plans for agencies, said she thinks the February forecast will make it easier to balance the budget. And the $ 3.15 billion that’s flowing into Minnesota The federal COVID aid law was passed in December will help too. The state and its economy could also potentially benefit from a third federal incentive proposed by President Joe Biden.

Article continues after advertisement

“I am delighted to be working with the House and negotiating with the Speaker and (Chairman of House Ways and Means, Rena Moran) and then engaging the Governor,” said Rosen. “We’re going to drill down and resolve this budget.”

State Senator Julie Rosen

Gazelka did not immediately endorse paying the summer school to make up for lost learning opportunities or to help schools regain government revenues related to declines in public school enrollment – estimated at 12,000 students – due to school closings and other disruptions. “Schools made the decision not to be in the classroom when science showed they could be in the classroom,” he said. “They decided – the teachers’ union and the governor – not to have the kids in the classroom … and now they’re asking us to save them for it.”

Walz reacted harshly to this statement on Wednesday. “We created a science-based system that every civilized nation and state followed.” he said. “It’s a pretty cynical approach and also incredibly unpopular what they’re about to find out. To act like that was the choice of (schools and teachers) and now you will punish them and punish our children is beyond the pale.”

However, Daudt repeated some of Walz’s statements about the budget creation process that began on Tuesday. “It will be good talking points for the governor and we will run into it,” he said. “This is a good starting point to contrast our ideas a little.”

But before May everyone must find a way to agree on a budget that will meet the needs of the state while creating “the economic growth that will lead us through this pandemic,” Daudt said. “And the only way to do it is together.”

Comments are closed.