Baby Tax Credit score 2022: How a lot is the kid help in these 10 states?

Ten states are providing families with financial aid after President Joe Biden’s Build Back Better scheme wasn’t approved in Congress earlier in 2022.

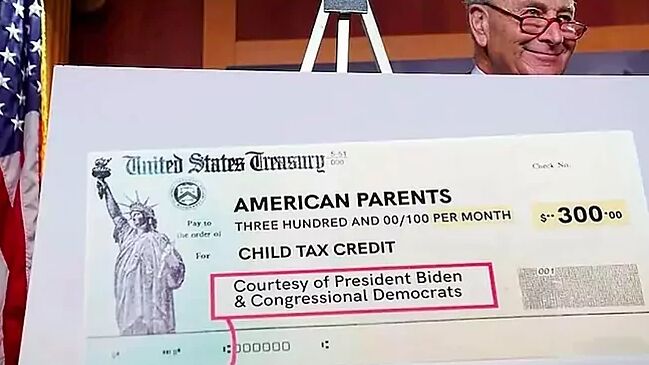

The existing Child Tax Credit (CTC) had been expanded to $3,000 per child under the age of 18 years and $3,600 per child younger than six years old after the approval of the American Rescue Plan Act in 2021.

However, the credit has now dropped back to a maximum amount of $2,000 per child, which has seen many families struggle to make ends meet.

Which states provide families with extra financial support?

Meanwhile, there are 10 states which are offering credits, with the amount of tax credit and eligibility requirements differing between each state, mainly depending on the children’s age and household income.

California: Payments of $1,000 to each family who earn under $25,000 and less than $1,000 to each household that earns between $25,000 to $30,000

Colorado: Each eligible child will receive between five percent to 30 percent of the federal credit, depending on income and filing status, from January 2023

Idaho: This State will offer $205 per eligible child as defined by section 24(c) of the Internal Revenue Code

Maine: As part of the Dependent Exemption Tax Credit, each family will receive $300 per qualifying child and dependent

Maryland: Each household with gross income of $6,000 or less and child with a disability under the age of 17 will receive $500

Massachusetts: Households will get $180 for one dependent and $360 for two or more dependents.

NewMexico: Each family will receive from $75 to $175 for every minor child which would qualify for federal income tax purposes.

new York: According to the official website, the amount is the greater of 33 percent of the portion of the federal child tax credit and federal additional child tax credit attributable to qualifying children or $100 multiplied by the number of qualifying children.

Oklahoma: Each qualifying child will receive five percent of the federal credit.

Vermont: Every eligible child will get $1,000 tax credit.

Comments are closed.